Personal Check Vs. Certified Check Vs. Cashier’s Check: Understanding the Differences and When to Use Each.

Various types of checks serve different purposes in financial transactions, each with its own set of features and benefits. Understanding the distinctions between personal checks, certified checks, and cashier’s checks is crucial for making informed decisions about managing your finances. Let’s delve into the specifics of each type of check and explore when it’s appropriate to use them.

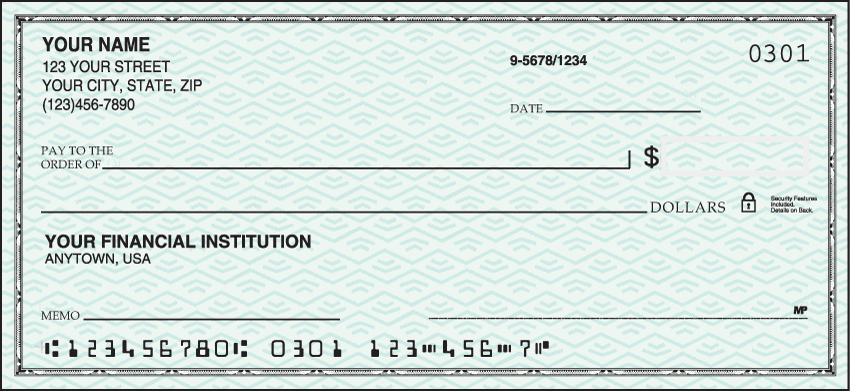

Personal Check

A personal check is a form of payment that draws funds directly from the issuer’s checking account.

Features:

- Typically used for everyday transactions, such as paying bills, rent, or making purchases.

- Requires the issuer’s signature to authorize the payment.

- It may not have guaranteed funds, as it depends on the availability of funds in the issuer’s account.

Advantages:

- Convenient for routine payments.

- It is easily accessible and can be obtained from most banks.

- Allows for tracking expenses through bank statements.

When to Use:

- Everyday transactions with trusted individuals or entities.

- Payments where immediate fund availability is not critical.

Certified Check

A certified check is a personal check that the bank guarantees as having sufficient funds to cover the amount.

Features:

- The bank verifies the availability of funds and “certifies” the check by stamping or signing it.

- Provides a higher level of security compared to a regular personal check.

- Typically used for larger transactions where the recipient requires assurance of payment.

Advantages:

- Offers a level of assurance to the payee that the funds are available.

- It can be helpful for transactions involving larger sums of money, such as real estate purchases or major investments.

- Provides a paper trail of the transaction, enhancing record-keeping.

When to Use:

- Transactions where the recipient demands a higher level of guarantee for payment.

- Making significant purchases or payments to unfamiliar parties.

Cashier’s Check

A cashier’s check is issued by a bank on its behalf, drawing funds directly from the bank’s account.

Features:

- As the bank guarantees, it is considered one of the most secure forms of payment.

- Typically used for large transactions or when immediate fund availability is essential.

- The purchaser must pay the bank the full amount plus any associated fees.

Advantages:

- Offers guaranteed funds, as the bank’s account backs it.

- Accepted by most recipients as a reliable form of payment.

- Provides peace of mind for both the payer and the payee.

When to Use:

- High-value transactions, such as purchasing a vehicle or property.

- Transactions where immediate fund availability and security are paramount.

Conclusion

Choosing the right type of check for a given transaction can significantly impact the efficiency and security of your financial dealings. While personal checks offer convenience for everyday payments, certified and cashier’s checks provide additional security and assurance, particularly for larger transactions. Understanding the differences between these types of checks and their respective use cases allows you to make informed decisions that best suit your financial needs and circumstances.